The year 2017 saw one of the most bustling activities in the history of China education industry. As we march into Chinese New Year, we are pleased to share the outlook of 2017. Are investors still eager to put their money in education ventures? Where are opportunities and challenges in China’s education market? Here are the trends of education industry we spot.

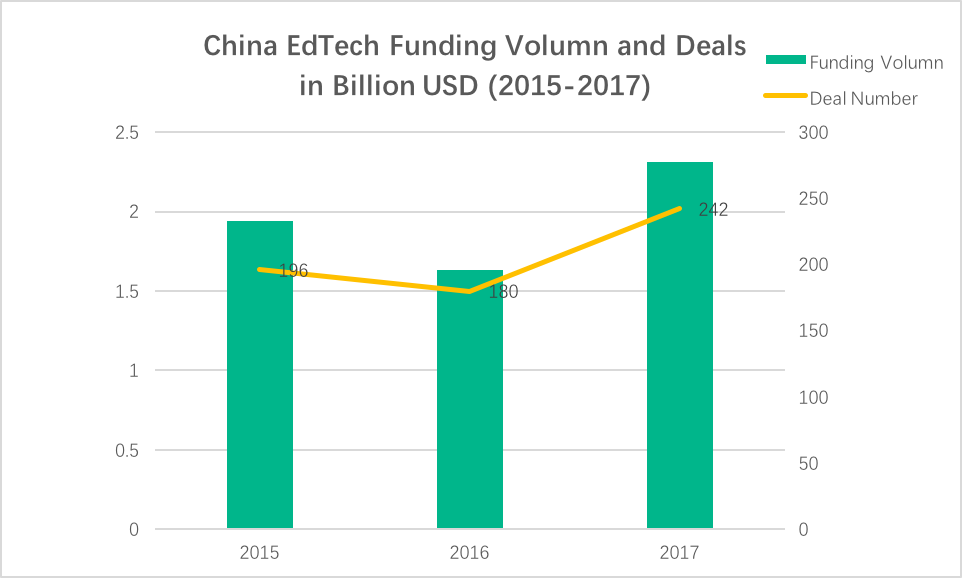

Edtech Investment Bounced Back

After the explosive growth in 2015 and tightening in 2016, China’s venture investment in EdTech has bounced back in 2017. Chinese Edtech has raised 2.31 billion USD (15.04 billion RMB) with 242 deals. Deals are concentrated in K12 subjects/ English online one-on-one tutoring, STEAM education, early childhood education and online vocational learning.

Here are the five trends we spot in China’s education market in 2017

Online language training in the spotlight

Exploration in STEAM education

AI-based Informationization of schools

School-enterprise cooperation in vocational training

Knowledge-sharing and life-long learning

New Opportunities in the Language Training Field

The Reform of China’s Gaokao (College Entrance Exam) put greater emphasis on listening and speaking skills of English proficiency. Provinces like Shanghai, Beijing, and Jiangsu have all added English speaking test in Gaokao. Beijing even added English oral test into the senior high school entrance exam in 2017.

Enthusiasm for language training was still high. Language training filed has raised 480 million USD (3 billion RMB) in 2017 with 45 deals. Companies like ABC360, Liulishuo, VIPKID, Acadsoc, and Alo7 raised more than hundred million financing last year. On October 20, 2017, Rise Education rang the opening bell in celebration of its initial public offering (IPO) on the Nasdaq Stock Market.

Compared to the online children teaching filed, which has already become“the Red Sea”, most investment and start-ups chose to look at online small classes last year, which may turn to be the next rising vent after the online one-to-one.

Challenges and Opportunities for the STEAM Education

Education consumption was upgrading, which led STEAM education to be the hot target of investment. In 2017, the growth rate of STEAM education industry was on the rise and attracted a lot of capital attention last year. However, because of the acceleration in industry integration, the crisis of small and medium institutions was also intensified.

Relying on features of comprehensiveness, experiential, interactivity and innovation, study tour and camp education experienced an explosive growth in 2017. However, these features also limited the application of technologies like artificial intelligence, which added the urgency to the need to find a way to raise the entry threshold.

Breakthroughs in Education Informatization Based on AI

Education informatization (term often used in China referring to the digital transformation of schools) is the basis and prerequisite for realizing the leapfrog development of education modernization, stated by the government. It refers to digital transformation of schools, which has greatly contributed to the improvement of teaching in the classroom.

For schools that had run a few rounds of information-based products in the first or second-tier cities, how to get the final big data by getting through the data of school platform and the product is one of the biggest perplexities of the principals. The informatization of education has gone through the stage of purchasing basic hardware and reached the phase of purchasing software, service and content resources. Data and intelligence are the future trends for sure.

The concept of “Future School” was a shared keyword in public schools and market-oriented enterprises. For the education information enterprises, products of digital and intelligent would become the key field of competition. More enterprises started considering B2B2C as their business model besides traditional 2B model.

Where Vocational Education Head For

In 2017, vocational education was becoming the focus of national policy. In the 19th CPC National Congress, President Xi announced the resolution to “improve the system of vocational education and training, and promote integration between industry and education and cooperation between enterprises and colleges”. More than 3,000 school-enterprise cooperation projects were on the list of the first batch of collaborative education projects announced by the Ministry of Education, which far exceeded that of the previous one.

School-enterprise cooperation covered the level of students from postgraduate to higher vocational and junior college. The studies were focused primarily on general IT and emerging disciplines related to the Internet, such as e-commerce, operation, etc.

In 2017, IT training remained a hotspot, and pre-employment education was of great interest. Early investments in career education were significantly reduced, which proved the industry to be more mature.

Going public, acquisition, and merge were still keywords for giants in vocational education. Among the IT training companies that received new financing in 2017, the development and training of new technologies such as artificial intelligence are main business.

Ups and Downs in Knowledge-sharing Economy

Knowledge sharing economy and knowledge-based pay has been very popular in China these years. Zhihu Live, Dedao, Qingting FM are all podcast platforms which open space for talented and professionals from all walks of life to arrange exclusive talks or speeches to address paying audiences.

Young users under 30 were the main force of consumption. They preferred courses for personal growth, business finance, and educational training. Socialization may be a way for new knowledge paid products to rise. Users get discounts when they share the products with their friends. The refined operation is also necessary. Stage-designed courses were found helpful in developing users’ learning habits and improving product retentions.

However, Zhihu Live was suffering high pressure in the last year, which suggested the novelty of the knowledge-based pay be gradually wearing off. For the knowledge industry, the expansion of category and content look very good but confuse the users if the quality of standardization and reasonable recommendation algorithm does not catch up, which was also the biggest weakness of the knowledge-based pay “UGC” model for now.