Decoding 2018 China’s Education Market | How is “the winter of capital” affecting education industry?

Last week, we illustrated and analyzed the investment trend and IPO boom of Chinese education industry in 2018. EdTech unicorns such as VIPKID, Zuoyebang constantly set new funding records in this space. According to EdSurge, the total amount of private equity funding of China-based EdTech companies in 2018H1 was about three times that of the United States.

However, just as we mentioned in the last episode, the private equity market has visibly differentiated in magnitude and early stage VC investments has decreased in 2018H2. So in the last piece of this series, we would look into the current challenges encountered in education market under the “cold winter of capital” after the boom fading, and how to cope in response to this economic slowdown in the private sector.

The “cold winter” of the education market

At the beginning of 2018, when the capital winter swept through China’s various industries, the education sector seemed to be still thriving. In the secondary market, TAL’s market capitalization exceeded 20 billion USD, making it the largest education company worldwide by market value. A cluster of education companies IPOed or were waiting to be listed in the stock market. After eight years, a second wave of IPOs for education companies has been witnessed since 2010.

Despite the seemingly flourishing education market, entrepreneurs and investors in this industry have realized that a storm was coming. Behind the listing boom of education companies, the entire domestic economic environment went downhill. Last year, the overall amount of venture capital raised in China — in both yuan and US dollars — slumped by 13 per cent to 302.5 billion yuan (US$44.5 billion). When looking at the education market itself, the losses of online education companies have become unbearable burdens for themselves and their investors.

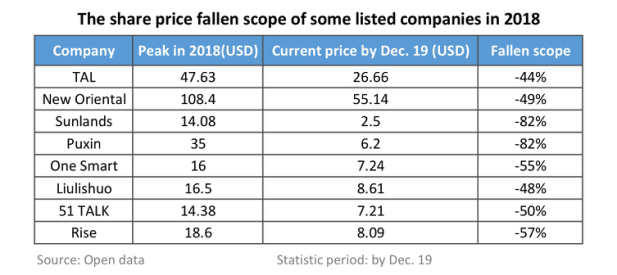

In June 2018, New Oriental’s share price fell below 80 USD and TAL’s plummeted down by 15%. The education companies that just listed in 2018H1 all suffered from a dramatical market slump at the beginning of 2018H2. This fall could be also seen in the primary market with the fact that the volume of investment and funding in 2018H2 was 28% lower than that in 2017H2, and 27% lower than that in 2018H1. More significantly, the total financing amount has shrunk by nearly 40%. Apart from this, K12 online companies have also been disclosed negative news report such as data fraud, scalping, spreading rumors of competitors, PR crisis etc.

The difficulty of acquiring customers in online education

Since the edge of leveraging the Internet economy for making profit has weakened, online education in its third thriving year in China still has to overcome the obstacle of customer acquisition. Monetization is always a pain point. In this context, whether to adopt the one-on-one model of kid English training or just small-size classes have been argued fiercely, resulting in the boom of small-size classes in the capital market. This is mainly based on the fact that the capital market has doubted the unhealthy UE model of one-on-one class while the small-size class has been verified to be scalable and gain high gross profit, clearly indicating the profit cycle for the investors.

However, with regard to the business model, small-size class is also not optimistic. Although the salary ratio of teachers in a single class is reduced, the cost of acquiring customers is still high. To further look into this, 1-on-1 training institutions raise the price of market launch and the high cost of customer acquisition still reaches thousands of RMB. The price of 1-on-4 pattern technically should be reduced by at least half compared to 1 v 1, otherwise it is hard to attract parents to pay. So for those who offer this type of classes need to rely on constant renewal of course fees from customers to break even, which also poses some pressure on their cash flow.

The urgent demand for Internet Traffic growth and monetizing

Reviewing the Internet industry in 2018, “growth” must be a keyword. A significant slowdown in user growth of online companies that have benefited from the first wave of huge online traffic can be seen. Newly established Internet start-ups that missed the previous rapid progress have put themselves in a place where urgent demand of traffic growth and monetizing is entailed because of the capital winter.

Under these circumstances, a series of new and trendy means of multiplying online traffic are constantly emerging such as WeChat fission to gain users, community operations for group effect, using mini-programs to generate leads, and doing Tik Tok (operator: ByteDance) short video marketing. After a few years of “Great Leap Forward” driven by capital hot money, the monetizing pressure of online education companies leveraging the Internet have been accumulated to the peak, therefore, online traffic, users, growth, and monetizing are among the most prevailing challenges they need to tackle with.

Nevertheless, the total amount of the internet traffic is limited. After the first group of pioneers discover a certain business opportunity, there will always followed by a large influx of entrepreneurs, speeding up the expending of channels and continuously leveling up the market entry threshold for latecomers. According to senior operating practitioners, new product categories can still get a chance in WeChat and benefiting from the last internet traffic wave of Tik Tok may last until 2019Q1.

The much colder the capital market is, the more struggle there could be. The process of bubble reduction is essentially a cooling process for online education ventures. We believe that for qualified education investors and entrepreneurs, 2019 will be a spring indeed as funds will be concentrated to companies with good products, well-designed contents and trustworthy service. And venture valuations will return to rational. It is high time that companies spared no effort to keep upgrading the products and investors improved their professional competences. Under the pivoting point of 2018–2019, a new era of education venture capital investment is coming, returning to the essence of education and the inclination of product itself playing the dominating role.

This final episode wraps up the four-article series “Decoding 2018 China’s Education Market”. When looking back China’s education market in 2018, we spotted the demands of consumers, analyzed the impact of policies, revealed the data on education investment and finally addressed the challenges in capital market as well as our forecast to get through this. In 2019, China’s education market is always open for overseas capital flow and embracing potential partnership opportunities with good products. And JMDedu will keep on covering firsthand stories and comprehensive reports from China’s education space on a weekly basis.