1.86 Billion USD Raised by China Edtech in 2019 Q1

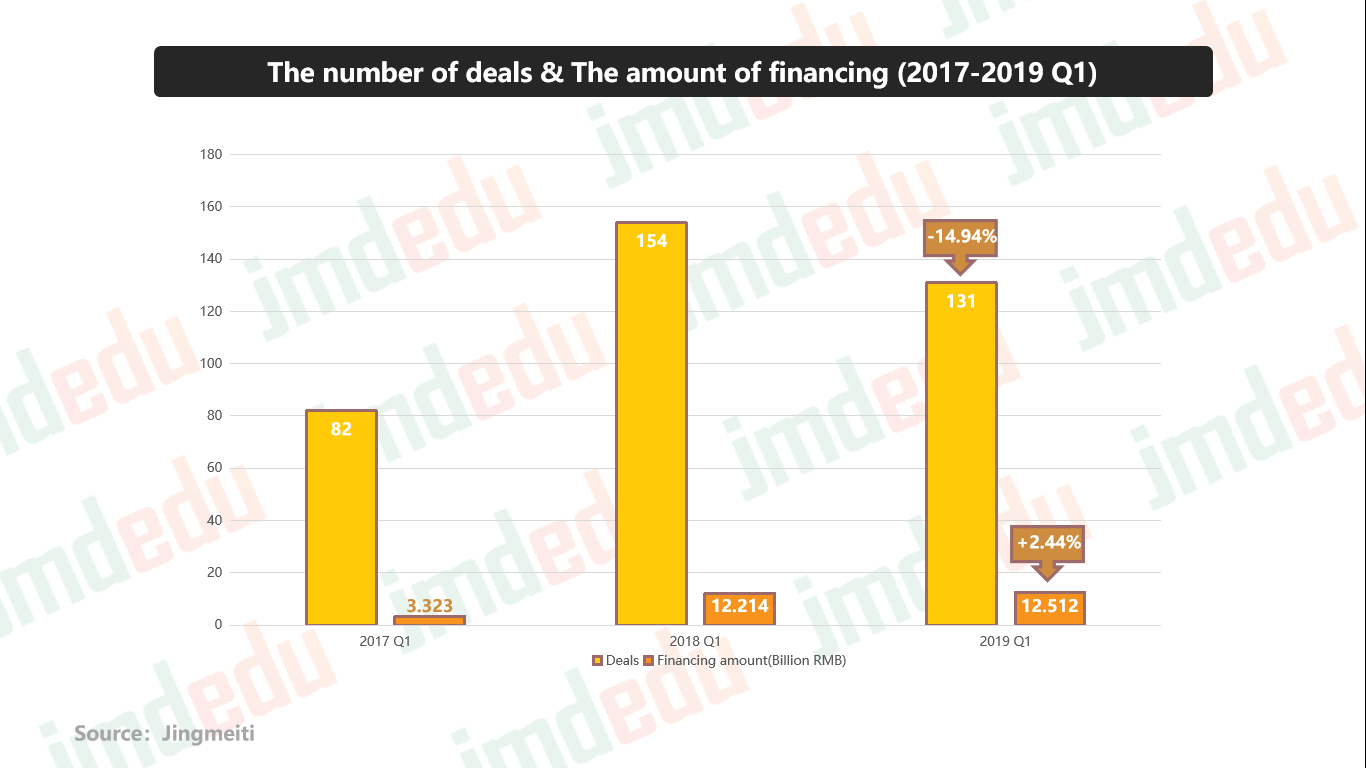

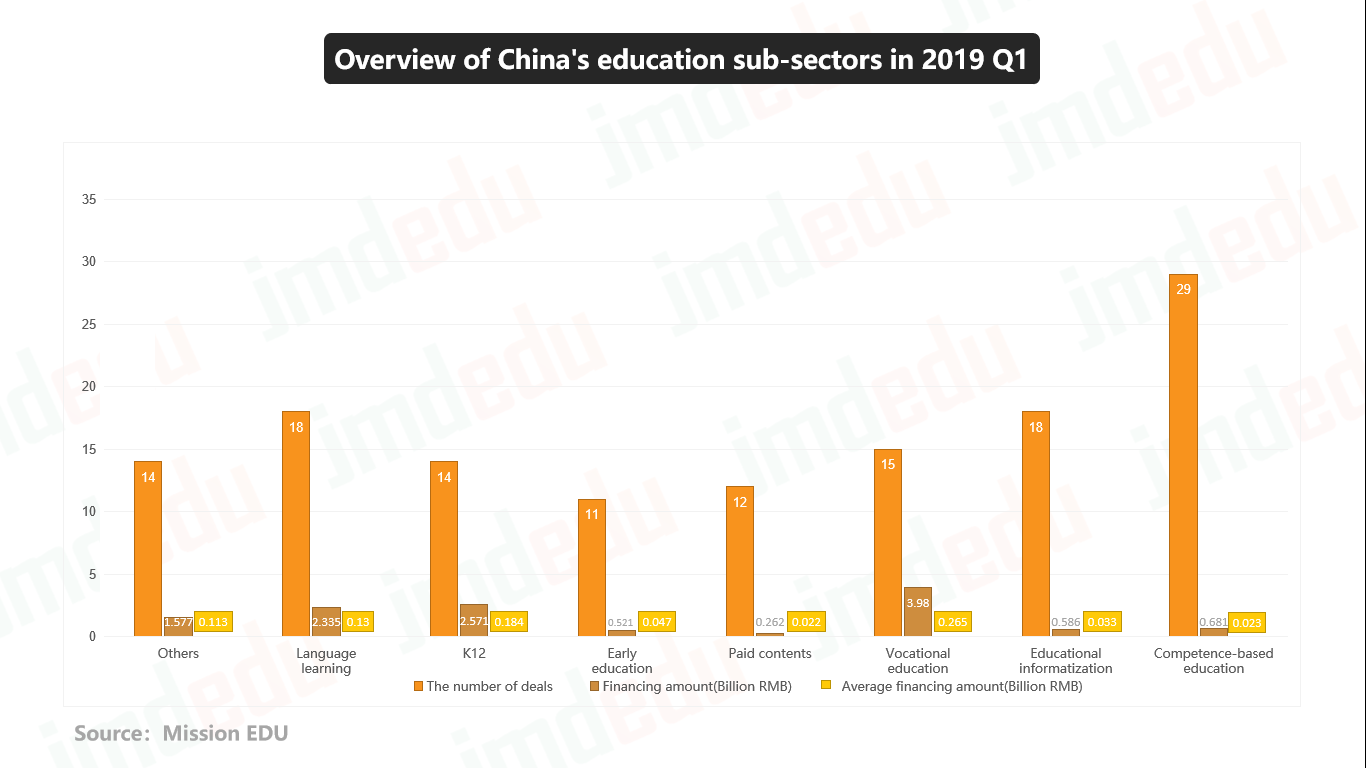

A quarter of 2019 has passed. In the last three months, 131 deals from China Edtech ventures have raised more than 1.86 billion USD (12.51 billion RMB), based on the data disclosed. Overall, competence-based education, language learning and education informatization are the top 3 sub-sectors where the funds are concentrated in. Most of the Chinese data in this piece are put together by Mission EDU and Jingmeiti.

Flourishing capital market & thriving online products

Slow as China’s economic growth may seem amid the “capital winter” in 2018, education industry appears to be a sector much less affected by the cyclical economic downturn. The venture capital investment amount is experiencing a slight increase in 2019Q1 compared to 2018Q1. Breaking down the investment volume by sub-sectors, the top 1 category goes to competence-based education which closed 29 deals in the last three months, accounting for over 22% out of all. Even though the number of deals in the vocational education came in fourth, the financing amount was the highest, attaining 3.98 billion RMB, approximately 1/3 of the total. This surge to some extent is attributed to the favorable policy carried out at the beginning of this year.

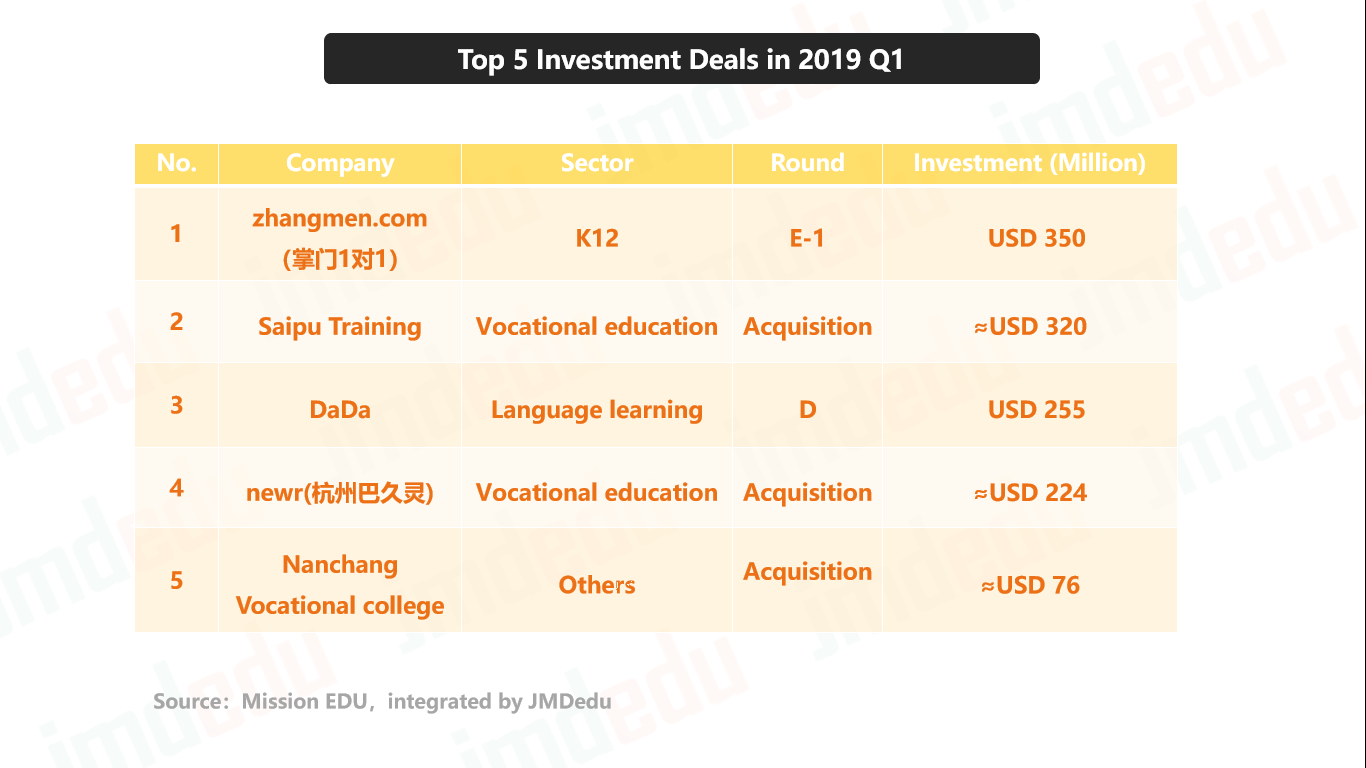

Noticeably, the highest volume of deals in vocational education is Saipu Training which was acquired for a sum of 2.147 billion RMB. They provide personal trainers and customized courses for working out in the gym setting. Other deals in this sector mainly involved new media and online education platforms. In addition, K12 and language learning are still favored by capitals.

In the K12 education sector, Zhangmen completed their first E round of financing, amounting to 350 million USD with the core business of providing online education services in a one-on-one comprehensive transformation. Huohua Siwei (火花思维) ranked second and announced the completion of C round with 40 million US dollars while VIPThink (豌豆思维) has secured its A round with 15 million US dollars. The two companies have similar business models, serving as online platforms of children’s mathematical thinking training.

Looking into language learning market, Dada raised 255 million US dollars in their D round funding, except Meten English offering offline English cources, other top 5 deals in this sub-sector are all online English learning platforms, such as Putao English (Angel round), Acadsoc (C1) and MicroLanguage (Pre-B).

Above all, it is not hard to find that online education platforms are growing remarkably, occupying half of the large-scale funds in 2019Q1. Competence-based and K12 education are still hot tracks and attract great capitals. The investment in vocational education is increasing with a bright spot of the cross-industry acquisition which is expected to be continuously developing in the second quarter of 2019.

TAL and New Oriental are the most active investment entities, both closing 4 deals in the last three months. New Oriental also made a prominent presence at ASU-GSV 2019 earlier this month by bringing an elaborately designed session: China Pop Up to the world’s leading education and innovation summit to help decode China’s education market for international players. During the session, they announced their long-term strategic partnership with ASU-GSV to embrace more east-west cooperation opportunities.

The era of “Big Chinese Learning” & The monetization challenge of kid coding

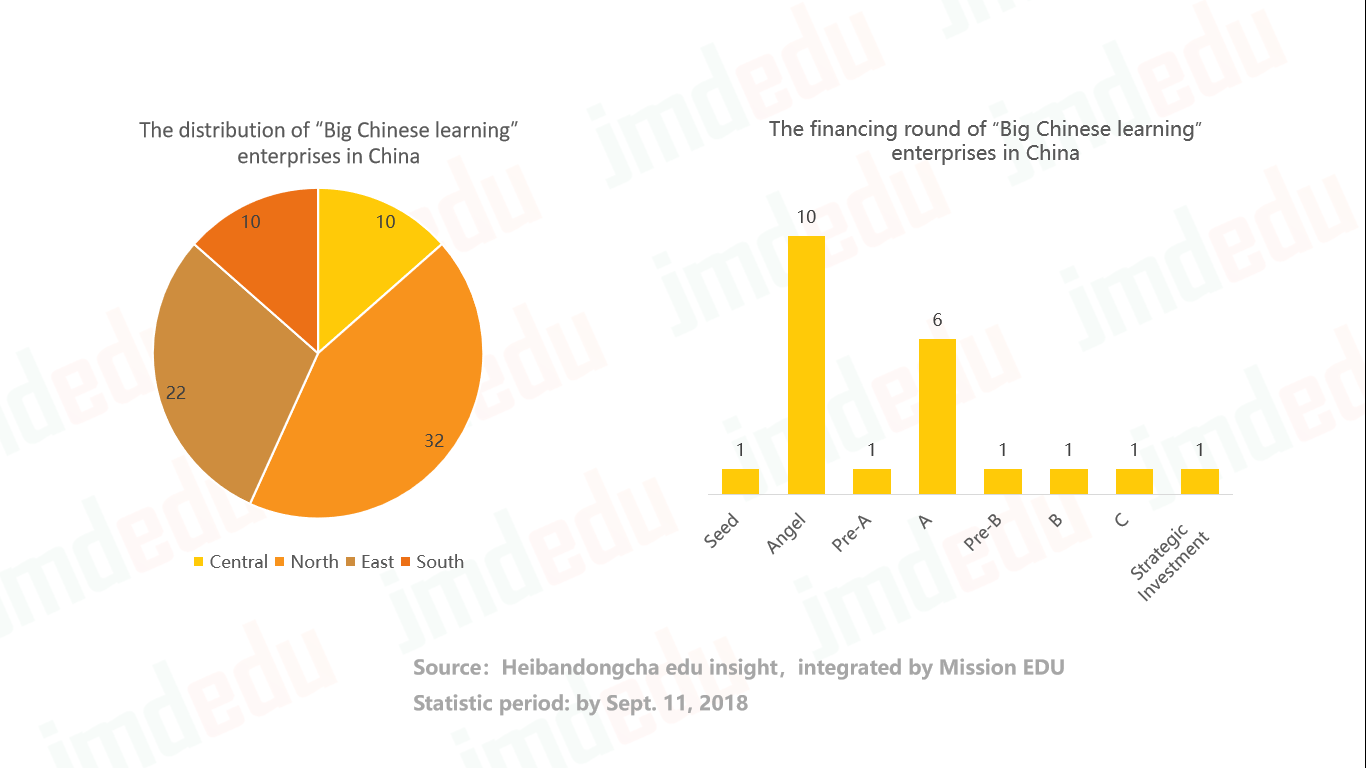

As we mentioned before, the number of deals competence-based education raised is the largest among all sub-sectors. One of the most significant factors contributing to this is actually a new trendy track emerging in this sector. “Big Chinese learning (大语文)” is undoubtedly EdTech’s next big thing in China. Many industry leaders speculate that the era for “Big Chinese Learning” is coming. This term refers to a new subject-based learning mindset and advocates a comprehensive Chinese language training combining both liberal arts teaching and exam-oriented model. “The ‘Big Chinese’ field will definitely breed the next unicorn,” said Yu Minghong, the founder of New Oriental. And in fact those investment gurus in EdTech are following this path. Blue Elephant Capital, Northern Light Venture Capital and TAL are all setting about new investment in this field. But most of the companies in this sector are still in their early stage.

When we look at the amount of funds raised by competence-based learning, it is not hard to find that among top five deals, three of them are kid coding companies, namely Hetao101 (A + round with 120 million RMB), Codemao (D round with more than 100 million RMB) and Xiaomawang (B+ round with 1 million RMB). The sub-categories of competence-based education are diversified while the funds raised are seemingly concentrated on kid coding. However, behind the boom, the problems caused by market demands cannot be overlooked. Kid coding is still not regarded as a rigid demand for most Chinese parents but is more likely to have something to do with tapping potentials or cultivating soft skills. At the moment, the market size is around 3–4 billion RMB. There is a huge gap between kid coding and kids’ English learning with a scale of 60 billion RMB, let alone K12 training. Nationwide, the penetration rate is only about 1.5%. In the future, with a growing number of top-down favorable policy carried out, the industry scale is predicted to reach 30 billion RMB in five years.

As we mentioned in the last piece of the series “Decoding 2018 China’s Education Market”, online small-class will also become a major trend. Due to the obvious diminishing effect of marginal cost, many one-on-one online teaching companies have begun to transform their business model to small-class. However, the multiple and complicated steps in the later operation stage of small-class model leads to relatively high operation costs. Whether this setting can still prove to be a well monetized model, maybe we can find the answer after Q2.