Looking into China’s Edtech Unicorns

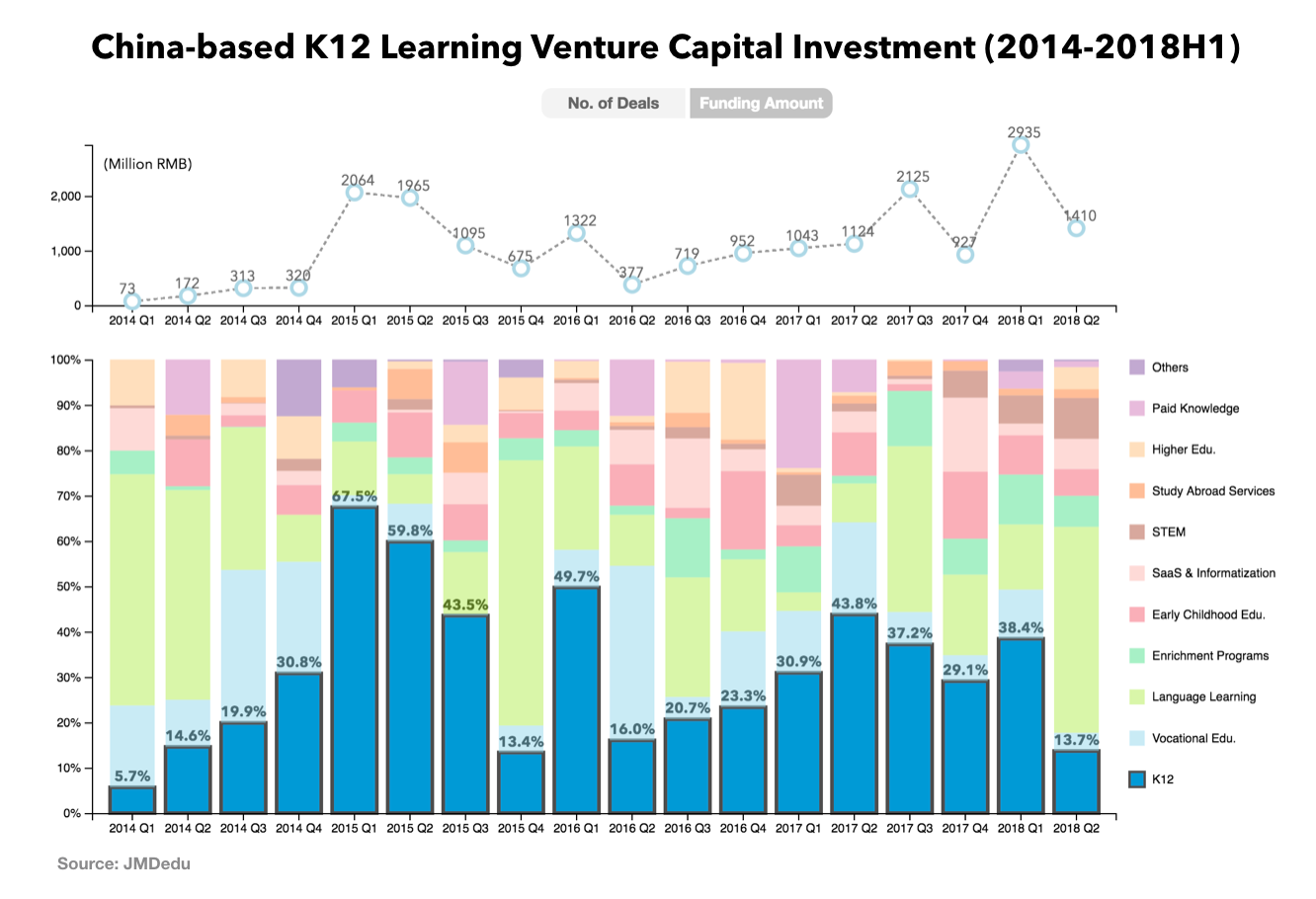

During the last five years, over 780 China-based Ed-Tech companies raised more than 9 Billion USD. And the top 5, all valued over 1 Billion USD, account for almost 20% of total funding. What has changed in the education space that attracts investors’ attention? And what remains unchanged? And what is it that they grow into EdTech unicorns in such a short time? What we can learn from their road to unicorns?

The consumer-facing nature of China’s education market makes a difference. Chinese parents are willing to invest their own money, more than 20% on average, in education. And in fact, the majority of Chinese students still goes to free public schools. Thus, most family education spending goes into after-school tutoring and classes, which explains the thriving of China’s two largest education companies, TAL, and New Oriental.

In recent years, mobile phones are penetrating in almost every aspect of lives, and it’s not hard for people to bring the habit into learning. Additionally, Chinese parents are demanding new learning experience for their children. It is promising for new entrants who can use technology to improve learning efficiency, solve teacher supply problem and enlarge access, and at the same time offer a different learning experience that satisfies the new generation of parents. These five Ed-Tech unicorns are good examples of such learning innovation.

Online one-on-one: Fast Revenue Growth

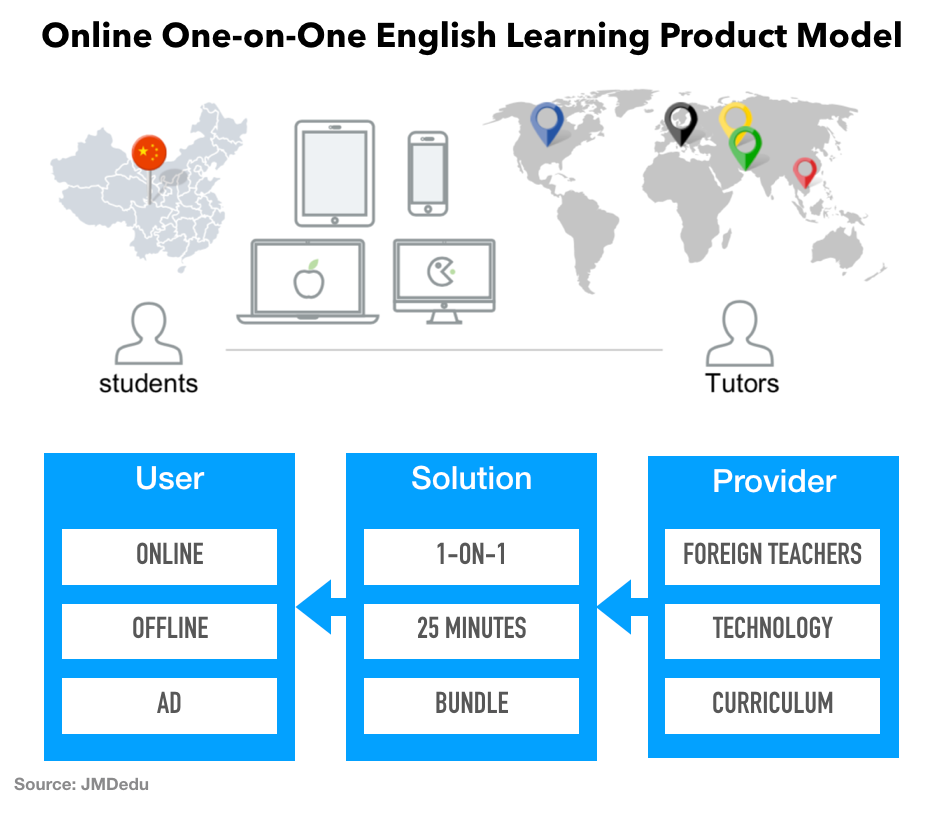

English learning is always a big market in China. New Oriental starts its business helping Chinese students improve English so that they can achieve a better score in TOEFL. Not only is English a must for studying abroad, but it also helps people become more competitive in the job market. It is widely held by this generation of Chinese parents that it is better to learn English at a younger age and with native-speaking teachers. Yet the problem is that it is not so easy to access a native-speaking teacher in China before. But companies, like Vipkid and iTutorgroup, now managed to connect teachers in US/UK to students in China on a larger scale by using an online one-on-one model.

The success story is learned quickly, and the online one-on-one model becomes a common practice in China’s education space. It’s like the emergence of Uber-for-everything: online one-on-one is used in teaching maths, coding, and even piano.

Free tool, Paid Tutoring

K12 supplementary learning is even a larger market than language learning, as it includes subjects as math, natural science, and social science, etc. It is also an area that draws most of the capital investment. K12 supplementary tutoring and classes are the top revenue source for both TAL and New Oriental. The last five years witnessed many efforts in how technology can innovate this sub-market.

One major type is called “question item bank”, represented by Zuoyebang and Yuantiku that claimed to have more than 50 million MAU. Based on the learning habits of Chinese students — worksheets, Zuoyebang and Yuantiku built a huge free question item banks grabbing all the published worksheet and exam questions into their system, so that students can search for the solutions for almost all the questions they might encounter in schools or in homework. They even make the search incredibly simple — students can just take a picture of the question in his/her worksheet and the app will give him/her the solution. This feature won them millions of downloads. Then, they can build personalized recommendations based on learning behavior data collected. After having huge users, the next question is how to monetize. The proven model is to offer paid online one-on-one tutoring and personalized online classes.

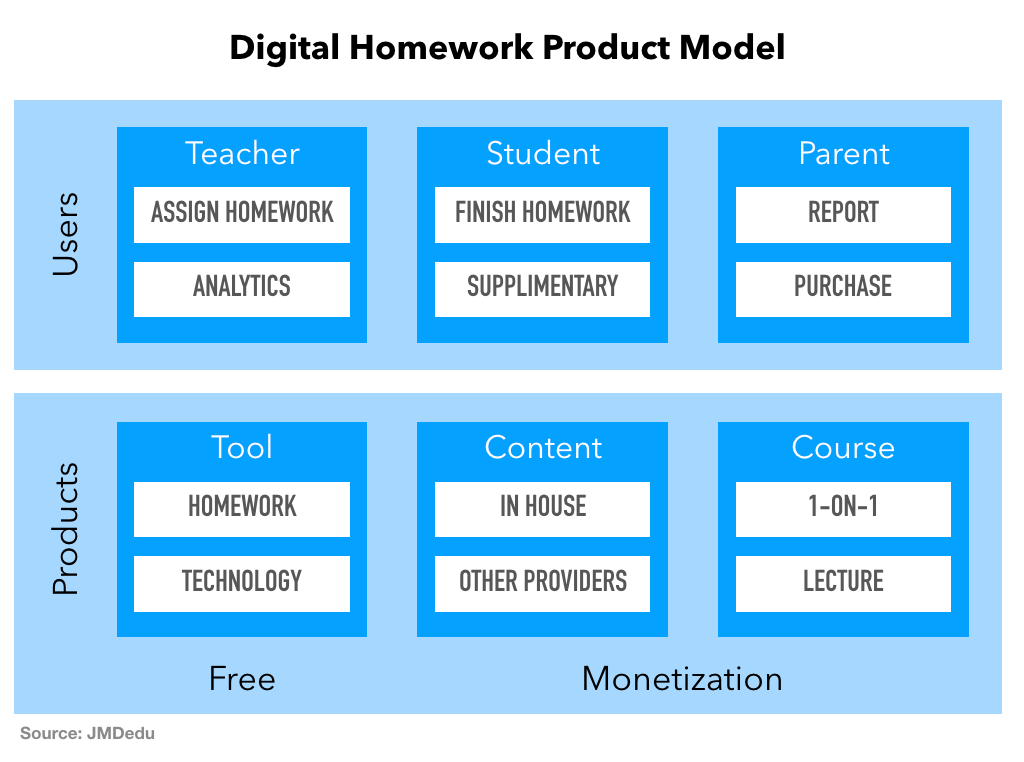

17zuoye, another unicorn in K12 space providing digital homework solution, uses similar idea——large users by free tool and monetization by paid content and courses. The difference exists in how they acquire large users. It built a database for homework and technology such as speech recognition so as to help teachers assign digital homework, grade automatically and get analytic reports. As homework is of high frequency, it becomes one of the most used digital learning apps. The digital homework product is free of charge. Its revenue comes from the premium content or online tutoring, paid directly by parents.