To vie for the very limited enrollment quota of top senior high schools or universities, Chinese students at K12 stage have no choice but to seek after-school tutoring for competing in one of the most grueling entrance exams across the world. According to the data from the National Bureau of Statistics, as of 2018, the number of students at K12 stage has exceeded 174 million. The surging demand for after-school tutoring has fueled up a thriving market valued at 400 billion yuan (US$58 billion) in 2018.

The estimate of this market size was made by Duojing Capital who recently released their “2019 K12 Online After-school Tutoring Industry Report” (hereinafter referred to as “Report”), pointing out that the industrialization and asset securitization in education industry has accelerated, and the IPO of education companies in overseas market has also remained vigorous. JMDedu put together some of the key points worth sharing with our overseas readers for a sneak peak at this industry’s 2019 performance.

Overview of China’s education capital market in 2019

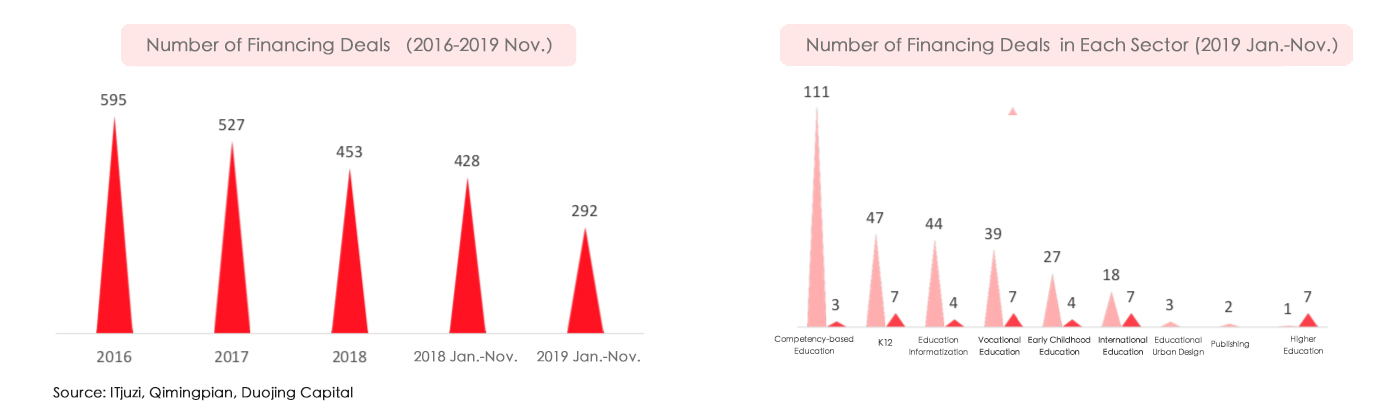

Amid a cooling domestic economy, the booming education industry has seemingly become a bright spark in the gloom of 2019 H1. However, the primary market in education space was not that immune to the deep-freeze, affected by financial market’s deleveraging and the slump of the real economy since mid-2018. Meanwhile, the government’s intensified scrutiny over different education tracks has escalated the investment risks. According to the open data compiled by Duojing, as of November 30, the number of financing deals (excluding M&A and IPO) in the primary market of education industry was 292 in 2019, with a year-on-year decline of 31.8%.

Among the 292 deals, competence-based learning topped the list with 111 deals closed, followed by K12 learning (47 deals) and Education Informatization (44 deals). Although vocational education has gained lots of policy support, only 39 deals have been closed which is far lower than the number of 69 deals in the same period last year.

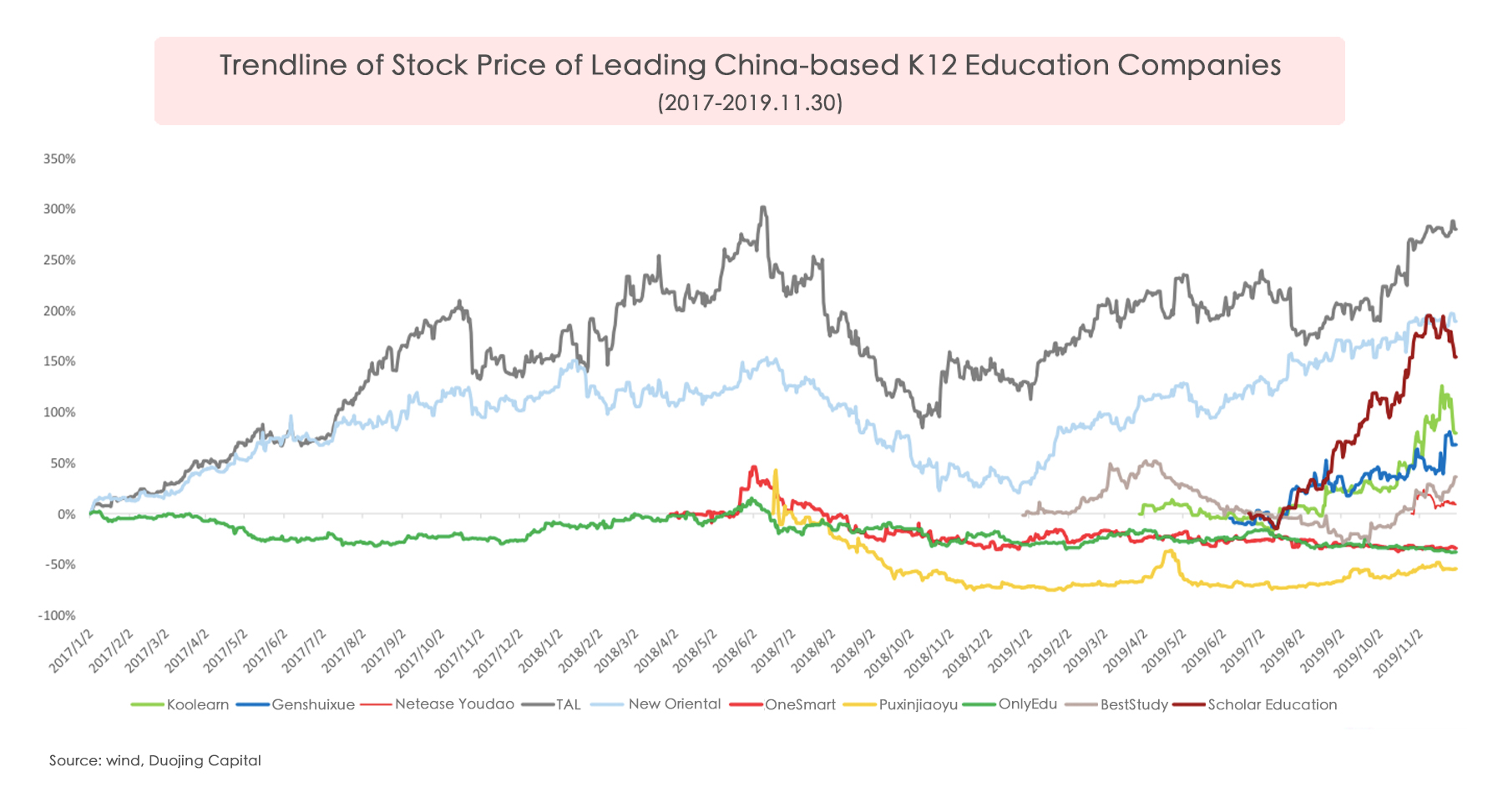

Moreover, dozens of national and regional leading K12 tutoring institutions have been listed on the A-share, US and HK stock, reflecting a more mature market and stable business model, as well as capital’s favor of K12 tutoring sector. Also, funding and resources are more concentrated in top players, represented by significant increase of M&A deals they closed.

OMO will be a key trend for business growth

According to the report, the market size of K12 after-school tutoring in 2018 is expected to hit over 400 billion yuan. Despite the viral online learning hype in recent years, offline teaching is actually the mainstream business model in China among this industry. But due to different provincial policies of senior high school system, college entrance examination reforms and geographical limitations, the market is extremely scattered that less than 20 offline tutoring players have expanded their business nationwide. Specifically, the reputation of this kind of institutions is largely based on the teaching quality, which is not easy to be kept at the same standards in different regions.

Therefore, with the development of technology and rapidly-growing mobile internet penetration, more business opportunities have been attached to online education especially K12 e-learning providers. Apart from English and Mathematics to which students usually make the most efforts after school, the reform of “New Gaokao” advocates a comprehensive Chinese language training combining both liberal arts teaching and exam-oriented model, several giants in this sector like New Oriental, TAL, Lanxum and Beststudy (Zhuoyue Education HK: 3978) regard this emerging learning mindset as a new business growth in their strategy so that more funding has been poured into the track known as “Big Chinese” with more than 25 financing deals closed since 2018.

Moreover, Duojing Capital believes that fierce competition in K12 after-school tutoring industry is spreading to third- and fourth-tier cities and online education business may be the only way for competitors in this game to break through. In this report, DJ Capital divides the online K12 tutoring players into three types:

As for the first type, offline institutions aiming to tap into online space have certain advantages in teaching but know less about the operation strategies of leveraging Internet traffic;

The second type is online education providers with stronger Internet DNA and know how to be favored by VC, however, they have less teaching experience so need to explore how to develop users’ online learning habits.

Leading Internet companies who are vying for the market share of the booming education industry are regarded as the third type. Tech giants such as Tencent, Alibaba, ByteDance, and NetEase, understand perfectly how to play with their huge traffic flow. But given the lack of educational DNA, they would prefer to adopt M&A and internal incubation as the expanding strategy to penetrate this market at the current stage.

Duojing Capital also proposed that one of the future trends is the mixed teaching model integrating one-on-one, small-size class and large-size class altogether. There is no doubt that various demands from families with students in different stages will stimulate diversified teaching models, thereby Duojing Capital forecast that the model of OMO (online-merge-offline) is likely to take off in this industry as it bridges the gap between online and offline learning platforms also facilitates user experiences.

Duojing Capital also believes that online K12 track has already formed a relatively complete industrial chain in terms of optimizing teacher resource, content development, and technical support; also the easy access to dual-teacher model and online platform allows customers to study and choose the learning models they like.

Social media is becoming the main access to more traffic flows

According to CNNIC, dataflow of usage ushered in an explosively soaring era since 2016 that most of the K12 after-school tutoring institutions started to provide online courses. But as we mentioned above, there lies a big discrepancy for companies with different DNAs to get traffic flows.

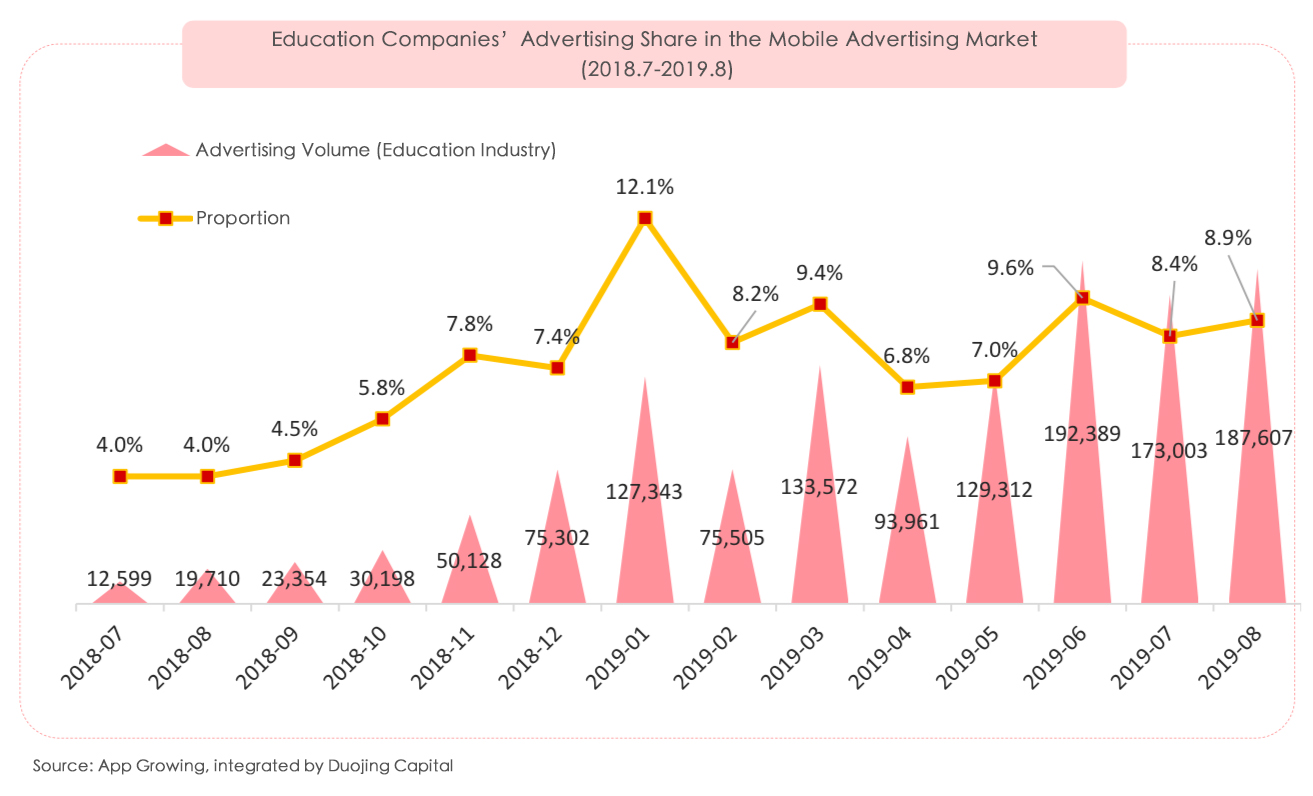

According to Duojing and 36Kr, in order to amplify brand exposure, 10 online education providers are estimated to invest a total of about 3 billion to 4 billion yuan, reaching more than 6 million students at the K12 stage. Approximately 15% to 30% customers have purchased the study plan at regular price after experiencing the trial class, and the renewal rate of class with the regular price has exceeded 50%. It is easy to do the maths that the total cost of acquiring one customer has been greatly pushed up, varying from 5000 to 8000 yuan when counting in teachers’ salaries and teaching materials, etc.

As for how to attract more traffic, Duojing mentioned in its report that the operations strategy should be associate with teaching patterns. The operation of online education means connecting the products (tools, curriculum and service) with users (students, parents and principals) by content, communities or related activities. Meanwhile, a wide range of social media platforms like Douyin (TikTok China) and Moments in WeChat with huge user base are providing new access to more traffics, diversifying online education companies’ means of customer acquisition and allows a transition from passive to more active.

There are reasons to believe that, according to some of the investors interviewed by 36Kr, with this burning-money model raging on, China’s K12 online education sector may spark the next $100 billion company. So the competition in this sector will remain relatively fierce in China to battle for joining the “$100 billion market cap club”.