Earlier this year, Youdao, an online education subsidiary of China’s internet giant NetEase, announced in April that it had officially merged with the original Netease’s Education Business Unit, incorporating its two major education services, “NetEase Cloud Classroom” and “China University MOOC,” under its brand. This marks the end of NetEase’s education business being driven by two engines and signifies that the parent company finally chose to bet their whole education business on Youdao, whose product matrix has reached a daily flow of 22 million users at that time.

Starting from mainly developing tool products, even amid the crowd of other leading education companies, Youdao is clearly a leader measured by number of users. In 2019, the number of its e-dictionary users exceeded 800 million. Actually in 2018, Youdao’s profitable revenue increased by 60% which was calculated to be the most in the whole NetEase group. Among them, the number of paying users for K12 courses jumped by 5 times, which undoubtedly shored up Youdao’s confidence in penetrating K12 track.

On August 6th, Youdao unveiled new four online learning tools for children and teenagers, focused on mathematics, English, reading and coding after the announcement of restructure in April, following the vision of building a lifelong learning ecosystem from K12 to vocational education as part of its geared-up push into the K12 battlefield.

Focusing on K12 to build a content-based product matrix

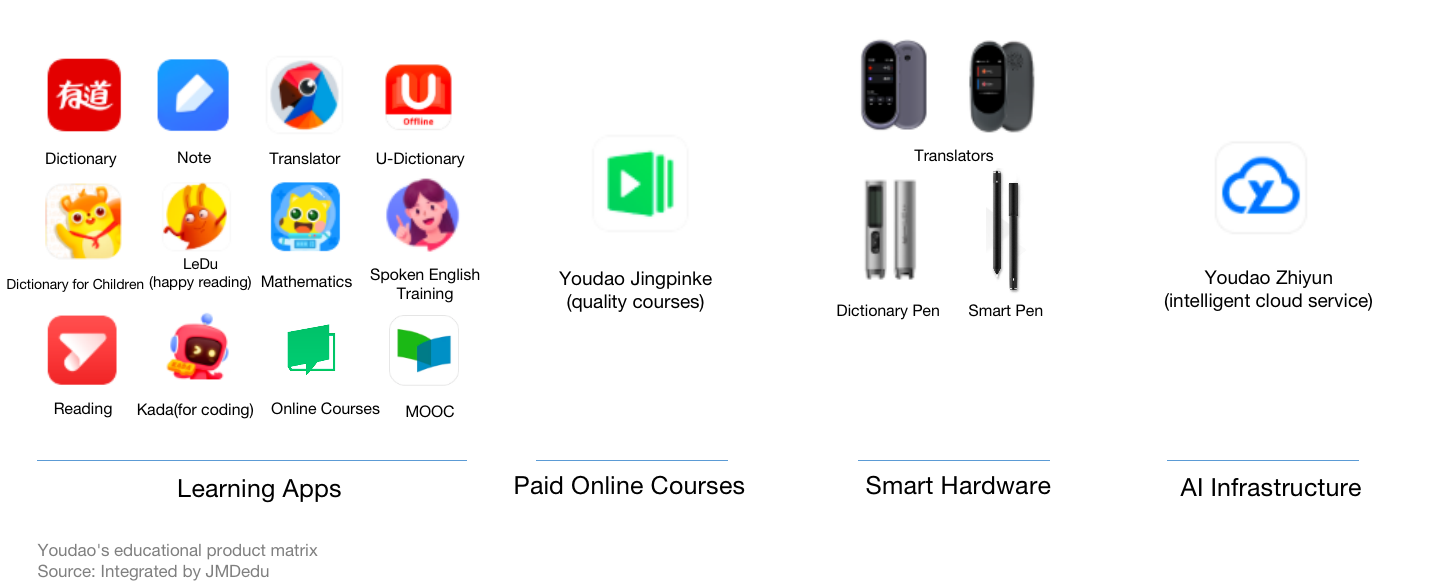

“Youdao is expected to be a technology-driven education company, building a full array of mass education products covering all age groups.” Zhou Feng, CEO of Youdao said. He divided Youdao’s product matrix into four segments: paid online courses as the core product, together with the learning apps matrix and the smart hardware, and with the support of Youdao “Zhiyun” (literal translation into “intelligent cloud service”) as the fourth part by providing AI infrastructure for three other sections.

Based on this, the future that Zhou Feng has envisioned for Youdao to tap K12 education is leveraging the main traffic pool from its tool products operated for many years, then providing teaching and learning service through online education product matrix and finally forming a closed loop connecting both online and offline through the intelligent hardware products.

Compared with the relatively fixed K12 offline education business layout, the competition of winning the market share in online K12 after-school tutoring has been constantly heated up. Tencent has successively launched K12-targeted products such as Penguin Tutoring, Tencent Coding and the English learning platform. JD.com also cooperated with Microsoft to launch the education edition of Minecraft in China. Due to China’s income rise and the burgeoning of middle-class family, parents have shown their willingness to pay for more education services especially for K12 tutoring as a rigid demand, giving rise to an extremely crowded market space.

Zhou Feng believes that to win the war in online training segment is simply a competition of education content and service. “Next, Youdao will emphasize our core positioning of a content and service provider, meanwhile, reduce our effort in exploring other directions at this stage.”

Developing personalized interactive learning platforms through “AI+hardware”

Another superiority for Youdao penetrating the K12 sector is bettering online users’ interaction experience with NetEase’s technology edges. Different from traditional education companies, Youdao, with internet DNA, especially the background of internet giants, has stronger technical capabilities and experience in R&D and operation of internet products.

Zhou Feng also mentioned at the product launch conference that their online course products will take the teaching model shift from the previous two-teacher into tripartite, that is, a teacher, a tutor and an AI teacher, meanwhile, utilizing the intelligent pen as an assistant, which Zhou believes can help improve teaching efficiency.

In addition, different from the online products that directly provide courses, the four new products launched this time are all content-based learning interaction which can help younger students to master the knowledge more easily through the technological means. Apart from the text recognition technology, Youdao also draws support from NetEase’s rich game operation experience as China’s second-largest gaming publisher. Luo Yuan, vice president of NetEase, believes that educational products must keep and positively stimulate children’s learning interest. In Zhou Feng’s blueprint, “besides online courses, the interactive content is expected to become the new standard for learning apps.”

Building a traffic pool with tool products to monetize

Apart from the technology and form, it is worth noting that Youdao’s new products based on content interaction only provide paid service but are still positioned as tools. Therefore, such products targeting at younger age group are not likely to compete with the products that directly providing online courses. But high-quality teaching content in such products will also attract more users, paving the way for the paid service targeted at live courses in the future layout. Building a traffic pool with tool products then monetizing through paid live courses has already been the a time-tested strategy that Youdao tend to adopt.

Netease’s CTO Lin Huijie once mentioned at the Global Mobile Internet Conference (GMIC) that the weakest link of the entire loop of “AI+ education” is data. Although teachers and students can generate massive data during the teaching and learning process, most of the data are still only available offline currently. Only by applying these offline data to the online product, continuously bettering the AI model through different types of data sets can make the AI model more mature and help to achieve the personalized service entailed for individual learning process. Youdao’s intelligent hardware products have taken on this role, that is, building a bridge connecting Youdao’s product from online to offline, collecting students’ learning data and paving the way for subsequent products.

Winning reputation and continuing to tap K12 sector

Suffering from the industry reshuffle since the end of 2018, the education business of the internet giants are now developing towards two main categories.

One is dedicated to B2B model that penetrating the education industry with technological edges by providing the infrastructure of smart campus or SaaS for public schools and institutions then looking for the possibility of transforming their business model to B2C. Tencent Education and Ali DingTalk introduced in our previous article can be regarded as good examples in the category.

Another is comprehensively pushing into the C-end market and focusing on “content + service”, which is the logic of the restructured Youdao by building its own course system as the basic solution. Zhou Feng believes that online education will eventually return to the essence of education. With that being said, the profit will come from scale economy, forming a positive cycle with “high quality + high reputation + large-scale.”

When starting to lay out the business in education industry at the very beginning, the internet giants always placed their key focus on adult education and also achieved certain success. However, such success does not mean more opportunities, which has been proved by the reorganization of educational segments in the NetEase Group. “Despite having the same rigid learning demands, the number of users in the K12 field is significantly larger than that in the adult education track and younger students usually have a longer usage period of learning products.” Said Zhou Feng.

Users are always influenced by their cognitive habits when selecting educational products, so it is not easy to reach all the users at different stages. But Youdao has already found its way to break through this predicament, that is, going all in on K12 sector and investing more in the development of contents and services to build a positive reputation then achieving a mutual improvement with the traffic flow from the tool products.

It was also unofficially reported last month that NetEase is seeking an IPO in the US of its Youdao arm to raise at least $300 million, propelling its expansion in the crowded online education market space. With the money raised, what will be Youdao’s next step? We will be following their story.