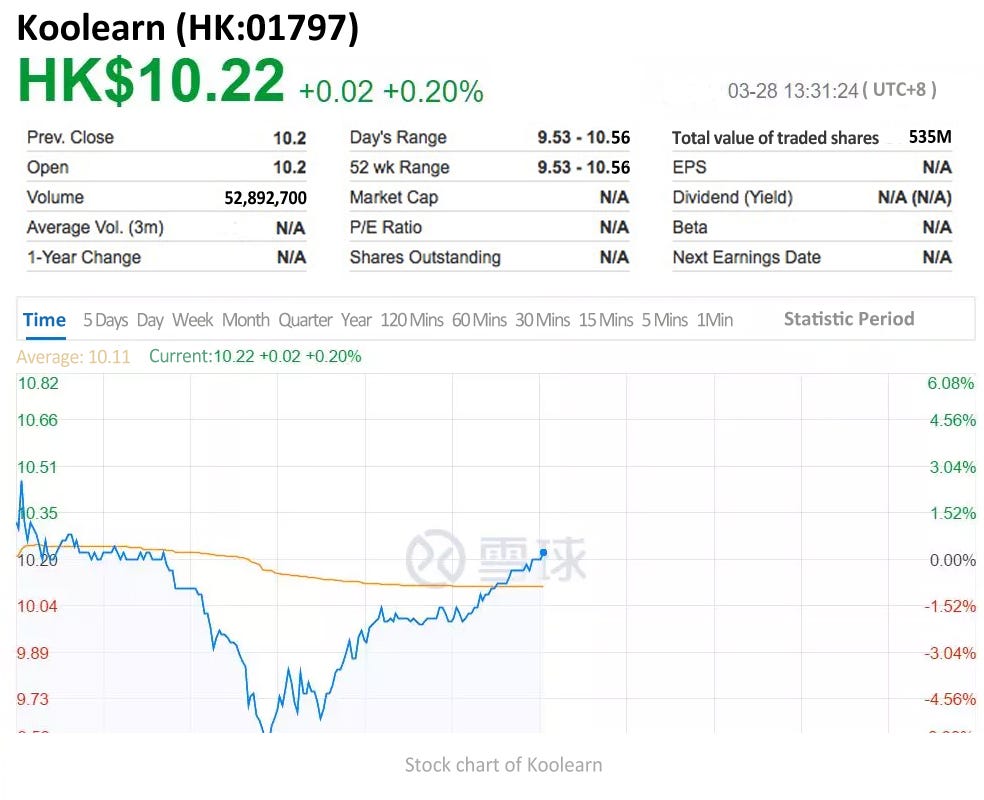

Hong Kong (JMDedu) — At 9:30am on March 28th, Koolearn, an online education company under New Oriental Education and Technology Group, has been listed in HKEX (Stock Code: 01797) at an opening price of HK$10.2, making it the first online education service provider to IPO in HK stocks. The net amount raised was about US$20 million (HK$1.567 billion).

As of 1:31 pm, the highest share price reached HK$10.56 and the lowest was HK$9.53. From the Candlestick chart, we can see that there was a short slump and back to normal quickly. The turnover has reached 535 million and the market value has floated at 9.286 billion Hong kong dollar. According to its prospectus, Koolearn reported RMB 477 million ($71 million) in revenue as of Nov. 30th in 2018, with a gross profit of RMB 281 million ($41 million). With that being said, it’s one of the few online education companies that makes profits.

Prior to this, many listed online education companies in China were challenged by high costs in marketing & branding for customer acquisition and payroll while Koolearn was able to make a breakthrough under the predicament and continue to make profits, which has gradually become an appealing focus for market research before listing. At the listing ceremony, Yu Minhong, the Founder of New Oriental, said that: “Looking ahead, we believe a good prospect in this industry, with our experience and Koolearn’s team spirits, we will open up new opportunities for our shareholders and investors with more fruitful returns.” But as we mentioned in the last piece, China’s economic slowdown imposed tremendous pressure to online education companies for reshuffling over the past year. So what can we learn from Koolearn’s successful model and how will Koolearn carry out the future strategic deployment to cope with the infinite market challenges?

Exploring the integration of Ed & Tech through investment and cooperation

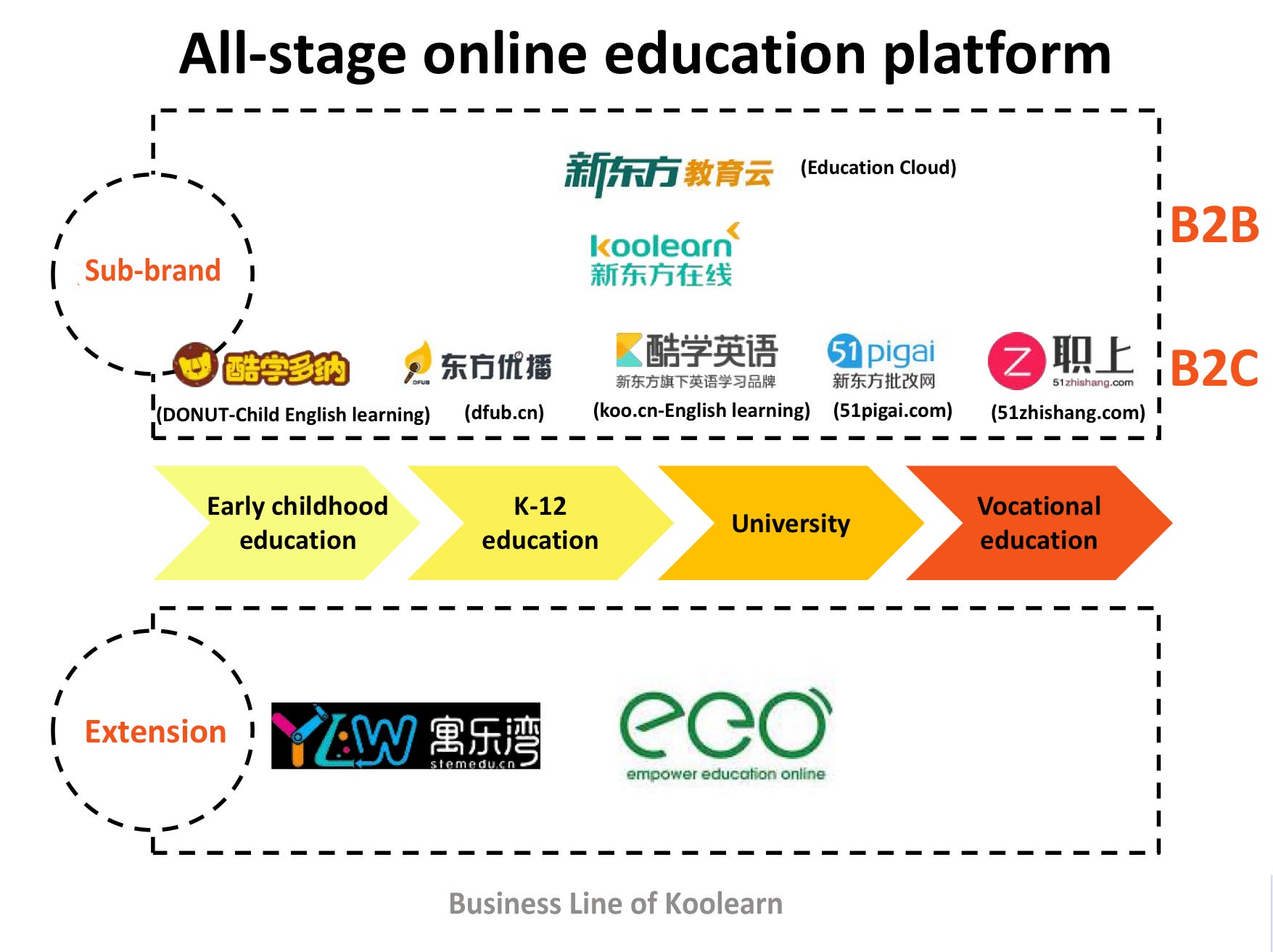

As mentioned in Koolearn’s prospectus, about 30% of the fund-raising will be used to selectively acquire or invest in complementary businesses. Looking back how Koolearn explored the model of integrating education and technology through years, establishing the associated company by equity contribution or investing in technology companies is actually the most common way. For instance, in 2014, New Oriental set up an associated company to launch an online vocational education product “Zhishang” with a intelligence test and evaluation service provider ATA and then cooperated with Tencent to launch an online self-learning product Uda. Then after establishing a K12 location-based online course product DFYB, Koolearn also led the investment of EEO, the provider of the interactive online classroom — Classin.

On the eve of the listing, JMDedu had an exclusive interview with Sun Chang, the co-CEO of Koolearn. She said: “Our expectation has always been that technology can be better integrated to the core of education. Our advantage is the education practice from its parent company New Oriental. So in terms of the attempt of technology, we will take the form of in-depth cooperation. Moreover, we will develop our own technology to apply only when we need deep integration of EdTech.” This form just stems from the attributes of the products launched by Koolearn. Different from many other technology-driven educational products, Koolearn placed its emphasis on curriculum and teaching development. Technology is only for positively empowering this process. “Through our relatively long history of exploring China’s online education market, if we find good technologies that can be integrated at different stages, we will use them.” Sun Chang said.

In the prospectus, Koolearn also revealed its plan to seek more content providers in the online education field and technology solutions that can create synergistic effects so as to enhance the platform’s strength in both technology and curriculum development.

Relying on New Oriental and Tencent to further enhance EdTech

The prospectus has also disclosed Koolearn’s resolution to cooperate and implement strategy with New Oriental and its second shareholder Tencent, which will also help Koolearn to go further on the road to tap the potential of Ed & Tech integration.

In the agreement with New Oriental, the cooperation is more weighted on sharing education and channel resources to defeat competitors. That said, New Oriental and Koolearn will continue to share the brand, data and any other online and offline resources. Meanwhile, New Oriental will also provide course content support for Koolearn. The two sides will cooperate more extensively in the context without competing, aligning with a recent interview of Sun Dongxu, co-CEO of Koolearn.

As for Tencent, the focus shifted to the synergy of technology. In the agreement of the prospectus, Tencent will provide telecommunications, messaging services, Tencent Cloud and payment services while Koolearn offers educational services to build more in-depth resource cooperation. “We also hope to cooperate more deeply with Tencent in the core aspect of education, but for now, we still need to continue to explore the direction.” Sun Chang added in the group interview after the ceremony.

The future: continue emphasizing on online education

When envisioning the developing trajectory in the next few years, Sun Chang said that the existing K12 business should be the priority for Koolearn. Then she shared the ideas in three dimensions. Firstly, Sun Chang believes that the current online course based on audio and video is not enough. She hopes that with the rise of 5G, Koolearn will be able to improve the effectiveness of online classrooms just as the real offline experience by more advanced technology. Secondly, Koolearn expects to leverage the power of AI to achieve a wider range of leveled teaching under the premise of reducing costs and improving efficiency. Thirdly, Koolearn aim at improving the user experience, which will be mainly addressed through the way information is expressed and demonstrated in the class. According to the prospectus, Koolearn plans to introduce more live courses with an attempt to strengthen the interactive functions of the courses, and broaden the application range of the adaptive learning system. At the same time, Koolearn will also devote itself to developing more interactive learning programs through WeChat mini-program thereby increasing the conversion rate of paying users.

Risks and Challenges: making progress while maintaining stability

In the group interview, Sun Chang and Yu Minhong both mentioned the situation in the pricing and road show of listing: the offering price of Koolearn is finally set at the middle value of the range. Sun Chang explained: “our roadshow works well and we have seen a lot of capital with a positive outlook about the future of China’s online education.” She said that why Koolearn did not choose the highest price is because they hope that the new shareholders will remain a long-term optimistic attitude and grow with them together. Yu Minhong also said that Koolearn does not welcome investors who are short-sighted.

Although online education is always favored by capital and considered to be a flourishing market, the risks still cannot be overlooked. The biggest uncertainty in private education is currently derived from the policy. Last year, the official began to require online education companies to disclose the teaching certificate of the employed teachers on the website. And the pre-charge should be no longer than three months. Based on this, Sun Dongxu, co-CEO of Koolearn, embraced the challenge also stayed quite optimistic in this repsect: Koolearn has adjusted its strategy simultaneously to accord with the adjustment of New Oriental’s offline business. However, due to the current policy, the number of candidates applying for teaching certificate examination has increased. So it will take some time for all the teachers to get the certificate. Sun Chang revealed that the current proportion of teachers who have certificates in the platform is roughly 50%. “We have gained extensive attention and support from government. Reaching the ratio of 100% is only a matter of time.” Sun Dongxu added.

In addition, the high cost of marketing is also a common problem faced by online education companies. Sun Dongxu said that Koolearn will mainly invest in building a medium- and long-term talent team and improve user experience instead of the marketing strategies merely with the goal of customer acquisition. Besides, with the brand value it carries from its parent company, Koolearn can really make less effort in marketing.

As Yu Minhong said in the listing ceremony: “Yesterday is history, tomorrow is the mystery. But today is a gift, that’s why it’s called the present.” New challenges and opportunities are waiting for Koolearn, how will this pioneer go further? Let us wait and see!