Last week, we analysed both the educational product consumption trends of middle-class families in some first- and second-tier cities in China and some relevant policies implemented by the government, which could provide a guidance for overseas companies to ascertain their consumer group and follow the governmental direction to a certain degree.

This week, let’s go through the investment and financing from both private equity and public market in China’s education space in 2018 so as to help overseas start-ups and capitals to get an overview of the education investment environment and indicate our prospect in 2019.

Looking into private equity funds

The education industry has been an increasingly appealing investment market from 2017H2 to 2018H1 by seeing capital flows from private equity reach its peak. In 2018, China-based EdTech ventures raised 5 billion USD with 538 deals. Overall, the funding has visibly differentiated in magnitude. The financing of previous projects has decreased in 2018H2, and the investment was concentrated in the middle and late top projects(头部项目). It seems that capital gradually returned to rationality.

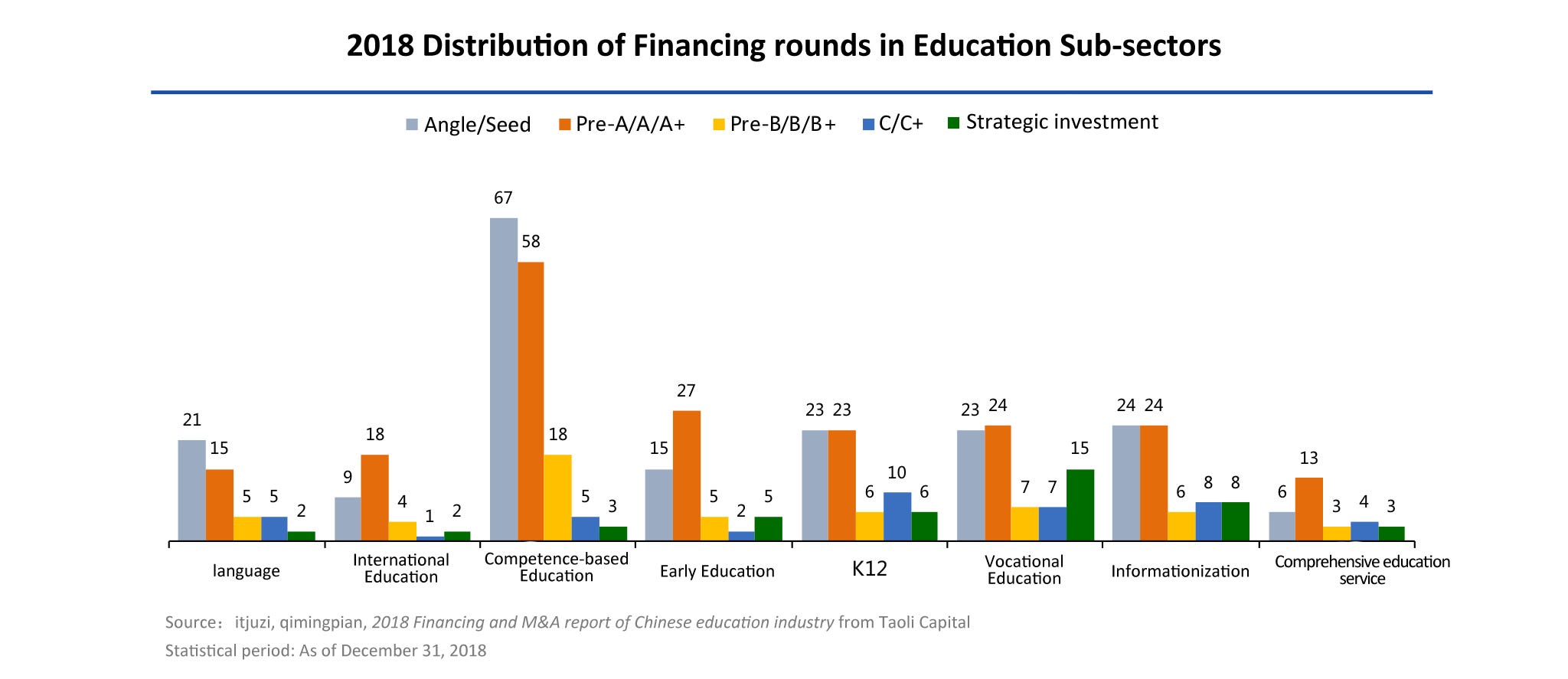

Breaking down the investment volume by sub-markets, we can see competence-based education has become a trendy track of the whole industry since 2017. The funding has been remarkably increased, generally concentrated in the early stage during the past two years. Competence-based education accounted for nearly 30% in the deals of 2018. Among the 151 deals disclosed, there were 34 regarding kid coding and 11 related to mathematical mindset. At the same time, vocational education, education informatization and K12 still account for a substantial percentage and the financing round gradually trended to the middle and late stages.

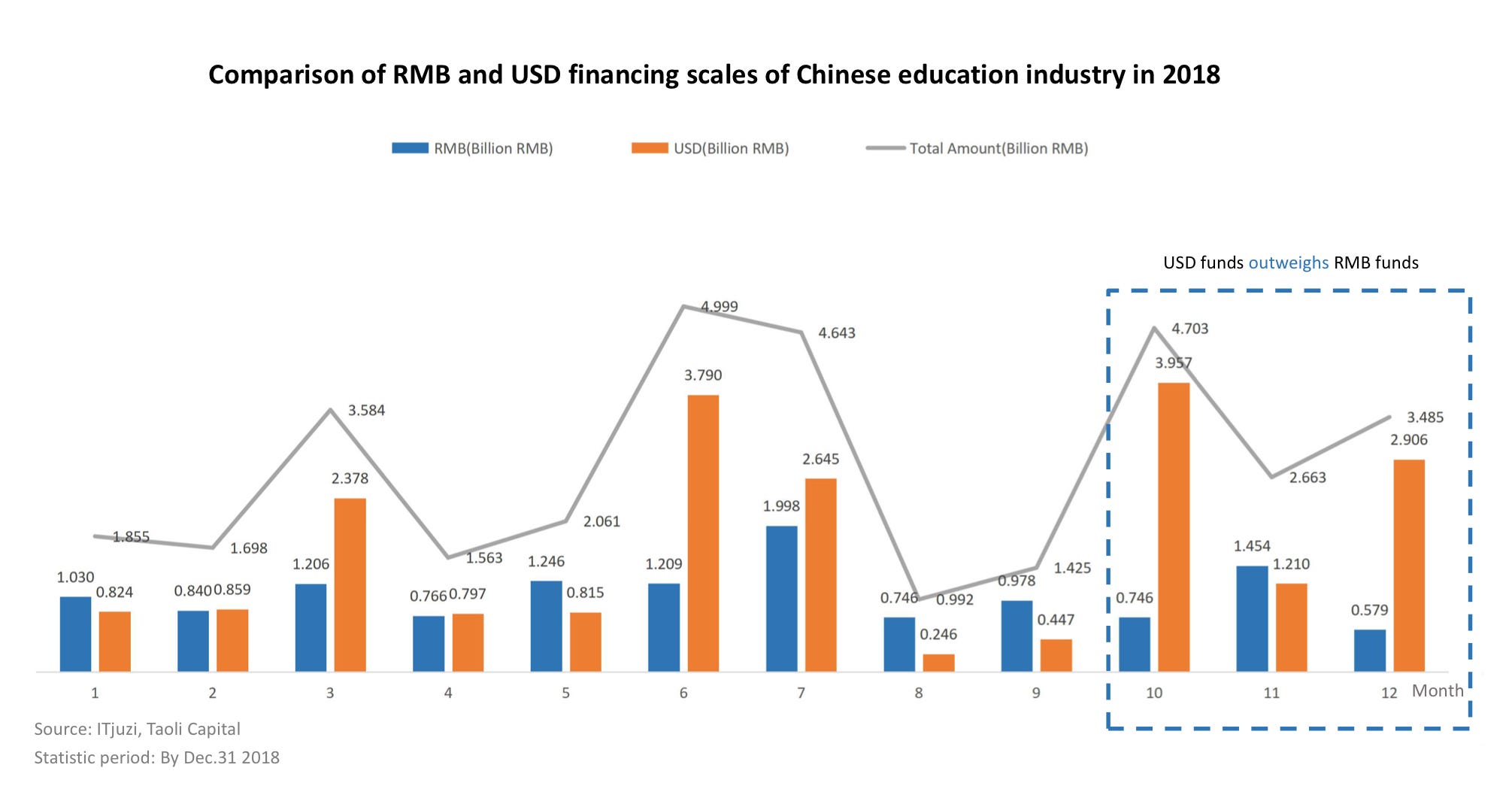

In addition, the volume of RMB funds has weakened in 2018 whereas strategic investment and especially USD funds have been more active. USD funds raised even outweigh RMB funds in Q4. According to Taoli Capital, the total amount of financing disclosed last year was close to 34 billion RMB, of which the majority of large cases were raised in US dollars each exceeding $100 million. This is due to the fact that in China, the currency exchange is restricted by the China Securities Regulatory Commission.

Zhenfund, TAL, and Blue Elephant Capital were the top three investment firms in the private equity market. The report showed that Zhenfund completed 20 investment cases in 2018, ranking the first. The investment cases of GSR Ventures grew from 2 in 2017 to 10 in 2018, which enjoyed the largest growth among other venture capital firms.

The majority of companies that are most funded lie in sectors that have rigid demand, a massive target consumer base, and are the earliest to adopt technologies. Two of the largest sectors are K12 online homework platforms and online language learning with native English-speaking teachers, amounting to over 80% of the top 10 investment deals in 2018. But we also see growing EdTech Unicorn emerging from competence-based learning sector such as VIP Peilian, a Chinese online music education platform. They are one of the earliest practitioners developing the “Internet + Music Education” model and now offer one-on-one online music practice courses. Zuoyebang stands out on the list by raising 2 rounds in 3 months with a total of 850 million USD, replacing VIPkid as the most funded EdTech company. It is a homework tool combined with ‘snap & search’ question bank functions, and online K12 tutoring services.

In terms of currency, 9 of the Top 10 most funded companies are raised in US dollars and only 1 in RMB. This somehow contributes to the fact that USD funds exceed RMB in Q4 and also indicates that these 9 companies are under VIE structure and are likely to be listed in the US or HK stock market.

Deep diving into public market

China’s education sector is relatively a stranger to the capital market a few years ago. However, the situation changed with 10 China-based education companies IPOed in 2017 alone. And the wave of looking for capital in the public market continued. In 2018, China-based education saw 14 IPOs and 35 M&A.

14 China-based education companies IPOed the past year and 12 are in the process. Private universities and K12 schools are the top category. Vocational training, language learning and early childhood education are also appealing sectors for investors. In terms of destination, 5 of the IPOed companies were listed in US. Some of the big names in China education sector, such as New Oriental and TAL, are listed in US. Just like them, NYSE and Nasdaq become the destination for China’s big K12 after school chains and online education providers. And 8 of them were listed in Hongkong. From the performance index in 2018 shown below, companies listed in Hong Kong enjoyed a 40% growth in market cap. Most private K12 school and university providers would choose Hong Kong as their destination for IPO. And according to their disclosed report, most of them enjoyed high profit rate. At the moment, private schools and vocational training are the two leading categories among those 12 companies waiting for being listed in Hong Kong stock.

The domestic market had a mediocre performance with only one IPO case. Offcn acquired Yaxia Auto IPOed in Mainland China so as to achieve its back door listing and became the first vocational training company listed in A share.

2018 witnessed 35 M&A deals, which is nearly three times of that in 2017. M&A from A-share companies began to slow down in 2017, and the A-share M&A market has been cooling down in 2018H2. However, with an increase of listed educational companies in Hong Kong and US, overseas M&A has gradually warmed up. From the report, there were 12, 12 and 11 M&A cases in 2018 for A shares, Hong Kong and US Stock Exchange respectively. In general, the deal number saw a downward trend through 2018.

With regard to volume, domestic M&A disclosed in 2018 was 5.8 billion RMB. And the top deal reached 3.3 billion RMB, which was the acquisition of My Gym by an A-share listed company named Sunlight(三垒股份). In contrast, overseas M&A totaled 3.6 billion RMB in 2018 with the average of 230 million RMB.

Investment Trends in 2019

In Taoli Capital’s 2018 Investment report, they believe that there are still plenty of opportunities for top companies’ fund raising and M&A. In the private equity market, monetisation and profit release will become the focus. And the valuation will tend to be rationalized. At the meantime, financial policy support will accelerate the recovery of the public market. Therefore, we recommend that companies enhance the management of cash flow. Financing layout should be completed as early as possible. And the expectation need to be planned reasonably.

In terms of the sub-markets, it is said that the top institutions of competence-based education may form an online integrated platform by expanding product categories, while the demand of products like new learning mindset and 2B scenarios can also be focal. In addition, there is a huge market for vocational training and recruitment outsourcing for blue-collar people. And the application of AI at early stage setting will also become a new opportunity.

Next piece will be the last episode of this series. We will talk about the “cold winter” faced by Chinese education industry in 2018 and analyse some of the major challenges as well as how to cope with them. So please stay tuned!