China’s education sector is relatively a stranger to the capital market a few years ago. However, the situation changed with 10 China-based education companies IPOed in 2017 alone. And the wave of looking for capital in the public market continued. In the first half of 2018, 6 education companied IPOed and 12 companies are in the process. Private universities are the top category, with 2 already listed and 6 in the waiting. K12 after schools, vocational schools and private K12 schools also draw the attention of investors.

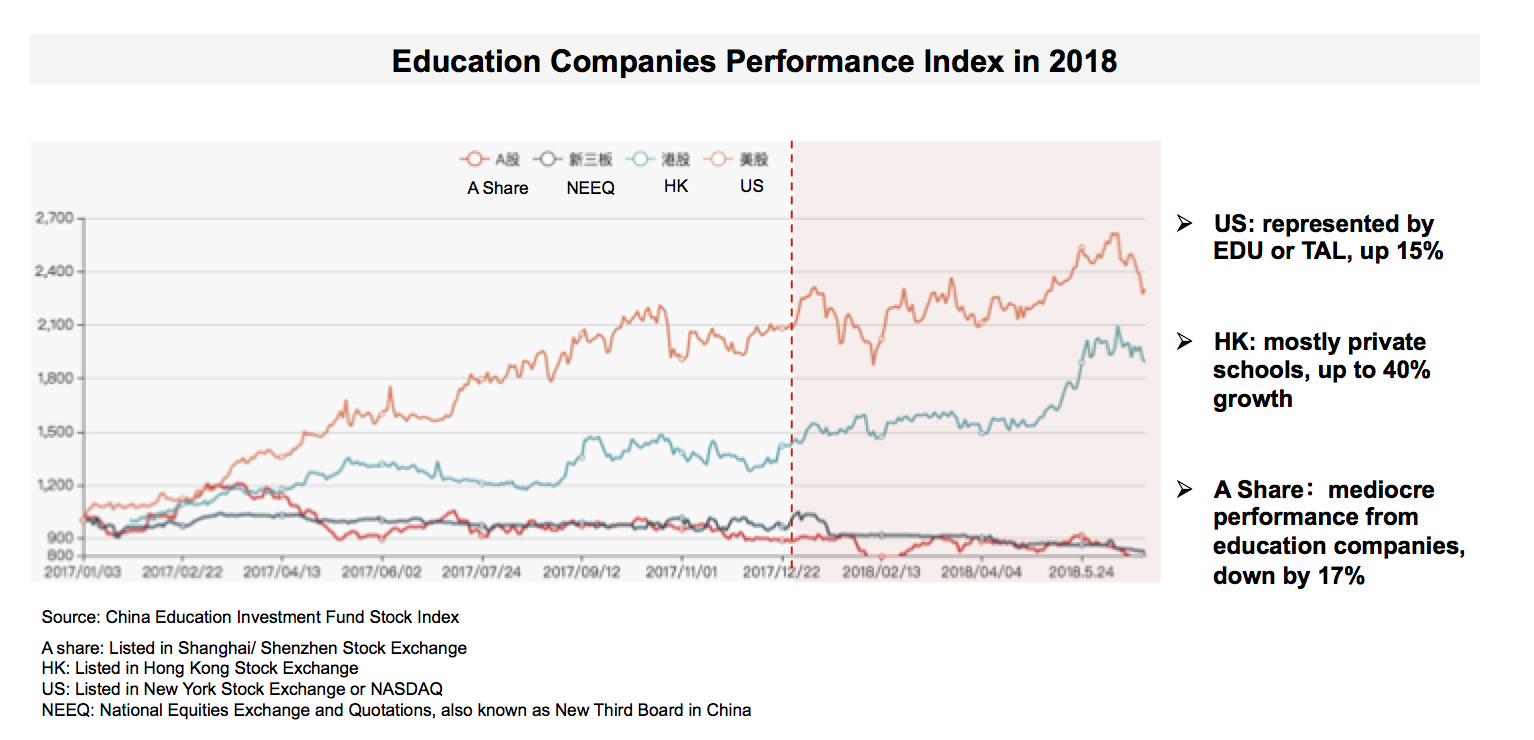

There are majorly three destinations for China-based education companies. First is the domestic market (A share), which is Shanghai or Shenzhen Stock Exchange. Second is Hong Kong Stock Exchange which became home for many private schools and universities. Third is to list in US, including New York Stock Exchange and Nasdaq.

From the performance index in 2018 shown above, companies listed in Hong Kong enjoyed a 40% growth in market cap. Most private K12 school and university providers would choose Hong Kong as their destination for IPO. And according to their disclosed report, most of them enjoyed high profit rate.

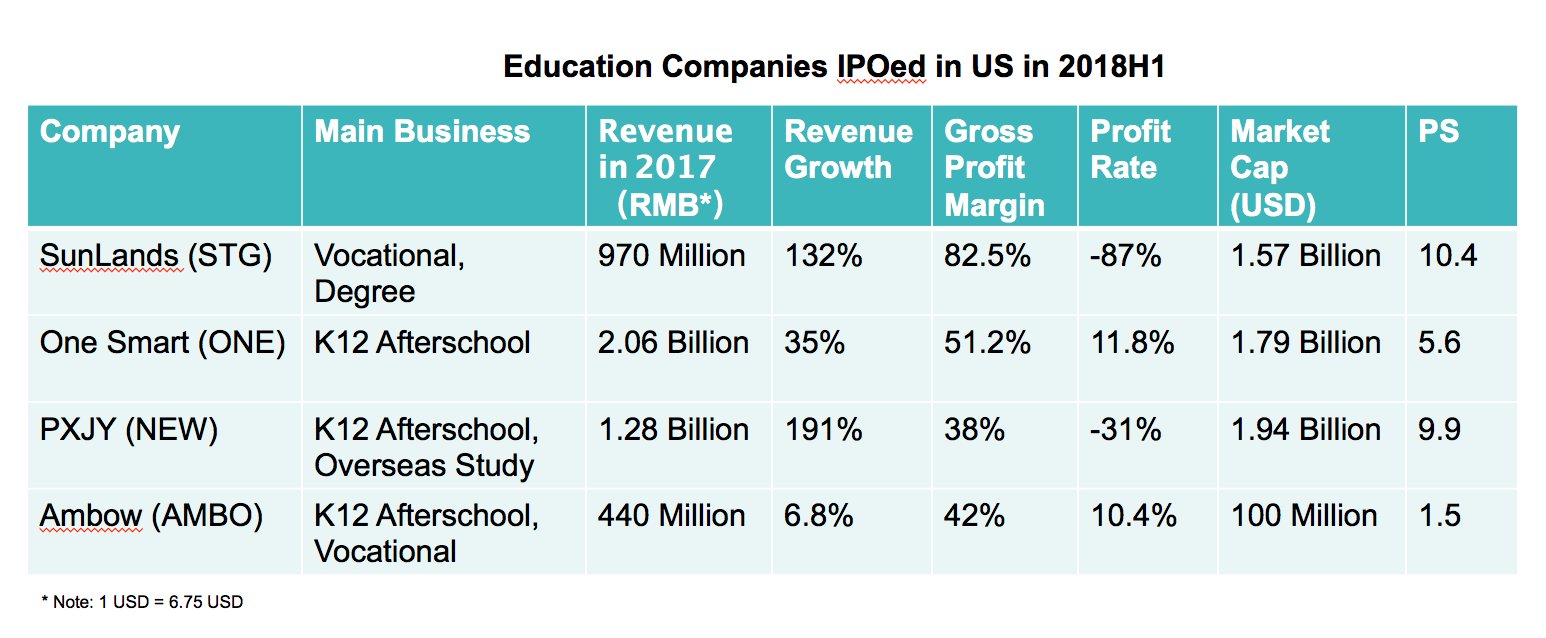

Some of the big names in China education sector, such as New Oriental and TAL, are listed in US. Just like them, NYSE and Nasdaq become the destination for China’s big K12 after school chains and online education providers. In the first half of 2018, four China-based education companies were listed in US, where growth overrules profit.

The domestic share markets had a mediocre performance in the first half of 2018. And as the new law of private education in China were just implemented in late 2017, we are still in the transition period and some listings in domestic market get delayed. At the same time, some public companies in domestic market, which didn’t have education business, start to acquire education assets.

In 2014–2016, M&A grew steadily with both volume and number of deals. With slowing of activities in 2017, the first half year of 2018 witnessed 14 M&A deals with 3.92 Billion USD, which is more than three times of the volume of M&A deals in 2017. The valuation of each deal grew greatly over the last few years.

The top three deals are from vocational learning, study abroad and early childhood learning. Fro example, Yaxia Auto (002607) acquired Offcn, a leader in vocational education with 2.7 Billion USD (18.5 Billion RMB) and hit raising limit for 8 days in a row. Acquisition of education assets becomes a new method to drive up revenue and profit.