Currently, the new generation of parents is mainly those born in the 1980s and 1990s. Different from the old generation, this group of people grew along with the development of the Internet. They have higher academic qualifications than their parents and attach greater importance to their children’s education.

In addition, the second-child policy has led to an increase in the number of newborn babies. Coupled with the new policy of early education, the early education institutions have sprung up and early education market has entered a golden age.

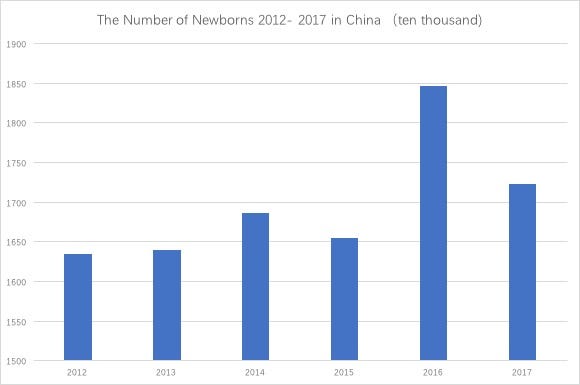

Sharp Increase in newborn populations due to second-child policy

From the graph we can see, the number of newborns each year was less than 17 million from 2012 to 2015. However, due to the second-child policy issued in 2016, China experienced a baby boom and the new population reached 18.46 million. In 2017, the new population was 17.23 million. Although compared to the former year, the growth rate decreased a little bit, the overall trend was upward.

With the increase of the new-born babies, the users of early education shall also surge. Together with the consumption upgrade, will greatly promote the development of the domestic early education industry.

The domestic early education market scale rises steadily year by year

The chart shows that the scale of the early education market in China is on the rise. In 2012, the market reached 12.6 billion USD (82 billion RMB), and by 2017, it became 30.6 billion USD (198.9 billion RMB), which was a giant leap for the early education market in China.

As the early education is not included in the 12-year consumption education, and the whole cost is covered by the parents, they tend to be conservative with the money spent. However, with the consumption upgrade, the proportion of expenditure on early childhood education also gradually increases. The growth of family income promotes parents to invest more in childhood education.

The proportion of children’s expenditure on early childhood education also gradually increases. Overall, family income promotes investment in education. It was predicted that the market size of early education industry would exceed 50 billion USD (300 billion RMB) after 2018.

Top Ten Early Education Centers in China

The table shows that opportunities in the early education market are huge for the foreign companies. Among the ten, the only complete domestic company is GYMAngel, others are either foreign companies or rely on global teaching systems.

Many early education industries adopt American education methods, which can be regarded as a double-edged sword. Parents are glad that their children can grow in a bilingual environment; however, meanwhile, they are worried whether their kids can integrate into Chinese society. Therefore, more innovations can be made in this field.

The Early Education Industries are favored by capitals

The developing of the early education industry attracted the capital’s attention to this field. From the table we can see, except ETM, which was founded in 2013, other companies were all newly established, which indicated the capital’s attitude towards the industry.

We suppose that the early education market shall continue growing in the next few years. Brand, teachers, teaching quality, products are still keys to companies’ competence in the field.